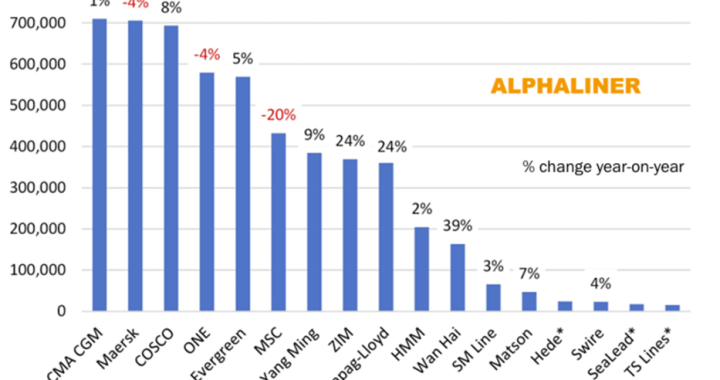

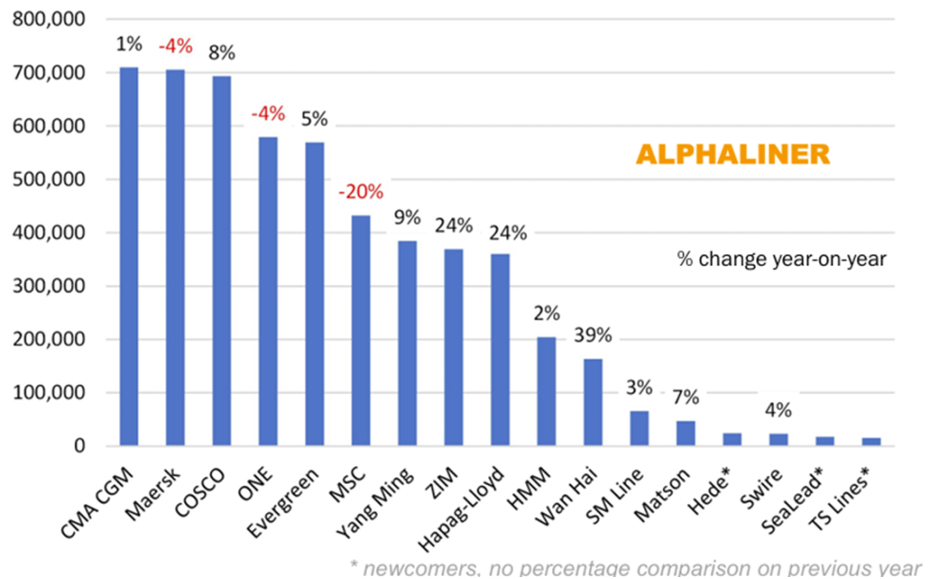

According to the latest Alphaliner research report, CMA CGM, Maersk and COSCO were in the lead on the trans-Pacific route in November, with the three liner companies deploying very close capacity.

Specifically, in November, CMA CGM’s market share on trans-Pacific routes reached 13.2 percent, surpassing Maersk’s 13.1 percent to become the largest liner company on trans-Pacific routes. Cosco Shipping Group ranked third with a 12.9% market share.

In November, the total number of container ships deployed on the Far East-North America trans-Pacific route was 562 with a total capacity of nearly 5.4 million TEU, representing a 4.2% year-on-year increase compared to November 2023.

Based on this, the capacity deployed on trans-Pacific route trade represents 17% of the global fleet. At the same time, due to the Red Sea crisis, which caused containers to sail around the Cape of Good Hope, the Asia-Europe route took up more capacity, accounting for 22 per cent of the global fleet.

Meanwhile, CMA CGM’s capacity on trans-Pacific routes rose 1 per cent, Maersk’s fell 4 per cent and COSCO’s rose 8 per cent.

The fastest growth on the Far East-North America trans-Pacific route was recorded by Wanhai Shipping, which saw a 39.3% increase in capacity compared to November 2023 and a 3.1% market share thanks to the deployment of a series of 13,450TEU newbuilds. It was followed by Zim (Zim) with a 24.1% YoY increase.

At the same time, strong demand, especially at ports in the West, has attracted three new companies – Hopede, SeaLead and T.S. INES – which, despite having only a 1% market share on the trans-Pacific route, have lost ground as Trump’s tariff 2.0 and the ILA-USMX impasse take hold. 2025 is expected to repeat the good outlook of 2024.

Alphaliner points out that in November, MSC, currently the world’s largest liner, lost 20 per cent of its capacity on trans-Pacific routes, putting it in sixth place. However, this is only temporary for now.

With the conclusion of Maersk’s 2M alliance collaboration with MSC in February 2025, MSC will redeploy its Far East-America routes, and MSC’s capacity on transoceanic routes is expected to grow significantly.

Contact us to know more one-stop service for sourcing solutions in China.